Your online reputation won’t only affect your bookings – but your hotel’s value too. Nam Quach tells us how and provides some tips for hoteliers readying their hotel for a merger or acquisition.

Your online reputation won’t only affect your bookings – but your hotel’s value too. Nam Quach tells us how and provides some tips for hoteliers readying their hotel for a merger or acquisition.

With a background in investment banking and a solid portfolio of deals he has helped to facilitate, including the sale of the Danube hotel portfolio (seven intercontinental hotels in Europe) for MSREF to a private investor, the sale of four iconic luxury Concorde Hotels for Starwood Capital to Constellation Hotels and the sale of Hilton International to Hilton Hotels Corp, if there is one thing Nam Quach can spot excellently, it is value – particularly in the hospitality and leisure sector.

We decided to find out what attracted this Managing Director of the UK branch of merger and acquisition firm, DC Advisory, to working with hospitality and leisure clients, what he looks at when evaluating businesses in the sector, and what he believes the true value of online reputation is for hospitality and leisure brands.

Where did you begin in the hospitality industry?

I started my professional career at a Swiss bank called Warburg Dillon Read (now known as UBS) and worked as an analyst in their investment banking division focusing on Leisure & Hospitality. It was a small team and I learnt a great deal from the people there. I enjoyed the sector so much that 17 years on, I am still focused on that industry.

What is your position now?

I’ve recently joined DC Advisory as a Managing Director. We’re part of Daiwa Securities and we focus on mid-market M&A transactions as well as raising capital for our clients across Europe.

What role do sites like TripAdvisor play when you're evaluating a hotel?

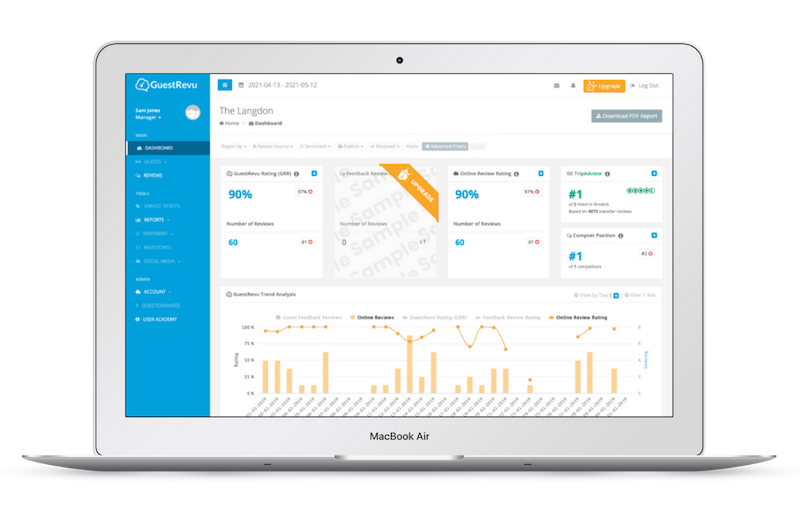

When we assess potential hotel opportunities for our clients, particularly portfolios, TripAdvisor is a very useful tool in gauging customer feedback. In particular, it allows us to assess quickly on a desktop basis the relative quality of the hotels in question vs. competitors in the area.

In some of our presentation materials to investors we would analyse the relative TripAdvisor ratings and highlight some of the feedback that comes up most often. This could be positive, such as great customer service or quality of rooms, or negative, for example the upkeep of the bathrooms. Nothing could replace an onsite inspection of the hotels, but if you had a portfolio of say, 30 hotels to assess quickly, TripAdvisor was a great initial tool to get an overall impression.

How does a hotel's online reputation affect its valuation?

Managing the online reputation of a hotel is very important. Valuation is made up essentially of two parts; the cash flow of the business, and the multiple that investors are willing to pay for this cash flow stream.

Firstly, from a trading perspective, a better online reputation will lead to more visitation and higher spend. This will appeal to repeat customers and attract new ones, and increased cash flow will lead to higher values. Customers today analyse a number of different touch points before making a buying decision, and analysing the online reputation (through sites such as TripAdvisor) is one important component.

Secondly, a better reputation online may signal other traits such as a well invested business, and therefore additional upfront investment required to address any shortfalls could be less. This could be in form of physical assets (carpets, the restaurant, etc.) or human capital. A hotel that has a good reputation online could also signal that it is well run from a CRM point of view and that it actively manages customer feedback.

Are there specific things that you look at when deciding on a valuation?

Every investor will look at valuation differently, and that is what, essentially, creates the market. The most common valuation factors when looking at hotels is a measure of profit and cashflow, say EBITDA (earnings before interest, tax, depreciation and amortisation) or NOI (net operating income) and the yield or multiple which is applied to these earnings. DCF (discounted cash flow analysis) is another way of assessing value by discounting the future earnings stream of a business. Every investor will have a different view on the earnings potential and the future, and will have a different view on risk, and hence value.

If a hotel wanted to ready itself for a sale, what are the key things you would advise it to do?

The key thing is preparation. These intense processes last a number of months from start to finish. Preparation is not just important from the transactional perspective that I focus on, but is also important for the business itself and the people affected by the sale (be it employees or management). It is often forgotten that hotels are a people business. Not being fully prepared could add delays to the process, or, worse still, give the impression to investors that it is poorly run. Being upfront and efficient with material portrays to investors that management is on top of the details.

Making sure that management and employees are continuing to drive the business forward during a sales process is also critical. This can be managed in a number of different ways (confidentiality, incentives, etc.) but the last thing we would want to see is a trading dip as employees are switched off. This will affect valuation.

What's the best hotel you've stayed in and why?

After 17 years in the industry I’ve stayed at a number of hotels, but for me the best hotel I have ever stayed in was the Conrad Pezula in South Africa. It was off-season, so very few guests were around. The hotel was beautiful and I had a lovely suite. I remember opening the doors in the evening as the sun was setting and just hearing nature play its song – truly spectacular.